Undoubtedly, I love fast food.

I have loved it since I was a kid. And after I worked on the strategy and insights team of a major fast food company a few years ago, my love for fast food grew even stronger.

Promising Prospects

The fast food industry is full of promising opportunities. Many fast food companies are pursuing aggressive strategies to expand their restaurant networks.

For instance, according to McDonald’s Accelerating the Arches Strategic Plan 2024, the global fast food giant plans to open 10,000 new stores within the next three years, aiming to surpass 50,000 locations by 2027.

Similarly, Domino’s Pizza has ambitious growth plans. As reported by QSR Magazine, Domino’s Pizza aims to increase its presence outside the US from approximately 13,400 locations in 2023 to over 18,500 in 2028.

In addition to restaurant expansion, fast food companies are focusing on recruiting new franchisees. Burger King, under the leadership of Restaurant Brands International (RBI), exemplifies this strategy. According to RBI Company Overview (February 2024), Burger King plans to rely more heavily on smaller, local operators to drive growth. These smaller franchisees, managing fewer than 50 stores, often achieve higher profitability than larger operators.

Clearly, the fast food industry is vibrant and competitive. Every player strives to win.

So, what is happening in the industry today? What trends are driving both the market and consumer behavior?

Digitalization

Every industry is going digital, and fast food is no exception. A quick glance at the annual reports of major fast food companies reveals extensive discussions about their digital strategies.

For instance, according to McDonald’s Annual Report 2023, McDonald’s is piloting the “Ready on Arrival” program in the US. This allows crew to assemble a customer’s mobile order before the customer arrives at the restaurant, improving the efficiencies of restaurants and elevating customer satisfaction. The company plans to roll out this initiative across six major markets by the end of 2025.

Similarly, according to The Wall Street Journal, Yum Brands, the owner of KFC, Taco Bell, and Pizza Hut, reports the its new pilots of AI-driven marketing campaigns are increasing purchases and reducing customer churn.

In the pilot, we delivered emails that were customized at an individual level. When we look at factors like the time of day, the day of the week, the subject line in the email, the content, and more, you can optimize that for marketing use cases like upselling, retention, referrals and even win-back strategies.

Joe Park

Chief Digital & Technology Officer, Yum Brands

With Domino’s Tracker, Domino’s Pizza allows customers to better anticipate when their pizzas will be delivered. At the same time, according to its latest Investment Day presentation in 2023, Domino’s Pizza aims to provide a more personalized customer experience using its data and generative AI.

New Entry Points

Fast food companies are actively seeking to boost guest counts by diversifying consumption occasions. For example, in October 2024, Pizza Hut launched a pop-up single-seat eatery in New York City, offering six-inch Personal Pan Pizzas to its customers with reservations. Traditionally, pizza is more seen as food for parties and gatherings. It seems that Pizza Hut wants to grow smaller group consumption occasions.

Tim Hortons, renowned in Canada for its coffee and donuts, is strategically expanding its cold beverage offerings, according to RBI Company Overview (February 2024). With these beverages, Tim Hortons hopes to get more customers who seek refreshments.

Cultural Fusion

I have lived in Shanghai for nine years and enjoyed the fried dough stick at McDonald’s for breakfast. During China’s traditional Mid-autumn Festival, I bought mooncakes for my friends at Starbucks.

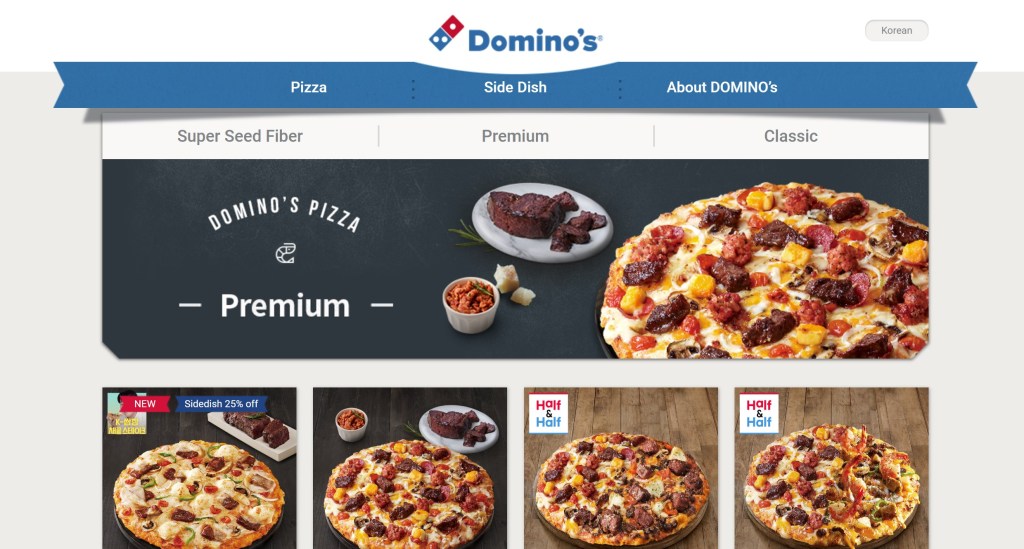

International fast food companies going local is nothing new. What surprises customers is that they are offering more cultural fusion menus. Look at Domino’s Pizza’s menu in Korea. You can find pizzas topped with steak seasoned with Korean “ssamjang” and pizzas topped with “K-Rib.”

KFC introduced the Chizza, a fusion of fried chicken and pizza, to the US in February 2024 as a limited-time offering. This innovative dish, featuring two Extra Crispy fried chicken filets topped with marinara sauce, mozzarella cheese, and pepperoni, first debuted in the Philippines in 2015 to cater to the appetite of the Filipino customers. Following its initial success, the Chizza was launched in various markets, including India, Thailand, Germany, Spain, and Mexico, before making its way to the US.

Chicken

Traditionally, beef has been more commonly used as the patty in burgers. Cheeseburger and Big Mac have long been iconic items at McDonald’s. However, McDonald’s is increasingly emphasizing chicken products. According to McDonald’s Annual Report 2023, McCrispy and McSpicy have been established as new global core menu items, joining the ranks of McNuggets and McChicken.

RBI seems to recognize the growing significance of chicken in the quick-service restaurant (QSR) sector. RBI Company Overview (February 2024) highlights that between 2022 and 2027, the global chicken category in QSRs is projected to grow at a faster rate than burgers, with an annual growth of 7.3% compared to 5.5%.

Value Options

With economic uncertainty, consumers tend to be more cautious with their spending. Yet, who doesn’t crave good food?

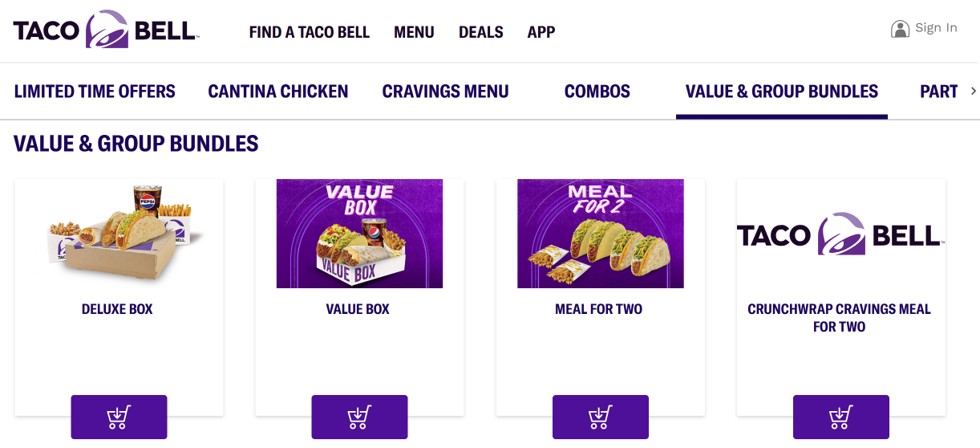

Consumers seek more reasonable offers, but they are not willing to compromise their appetite. From Yum Brands Annual Report 2023, Taco Bell believes that every person deserves the right to “Live Más” (that is, to live more.) As a result, driving unparalleled value is a key part of the brand’s strategy. Taco Bell offers value and group bundles in many markets, such as Canada and India.

Similarly, McDonald’s Value Menu is consistently available and actively promoted through different channels.

Now look at Pizza Hut in China. Recently, the brand has introduced new concept stores offering smaller and more affordable food options in China, aiming to attract cost-conscious customers. Who can resist the temptation from a pepperoni pizza for just 29 yuan (USD $4) or a plate of pasta for about 15 yuan?

Other Trends

There are numerous other trends in the industry, such as food delivery and enhancements to the restaurant experience. All these trends are well established, I won’t go into detail in this article.

Final Thoughts

While prompt reactions to industry and consumer trends are essential, players in the fast food industry must continuously evaluate the key enablers of success. They should consider asking the following questions:

- Are franchisees aligned with our corporate strategy? How should we communicate more effectively with them?

- Do customers find our food, both core items and limited-time offers, relevant and exciting? How should we design better menus?

- Is our current quality control adequate to ensure our food is consistently delicious?

- Do we have enough data to truly understand our customers?

What do you think? Let’s discuss.

Vincent

Leave a comment