Mainland Chinese consumers are known for their strong affinity for luxury products. According to the 2024 China Luxury Market Insights Report by Tencent and BCG, these consumers spent approximately RMB 558 billion on luxury goods in 2024, marking a slight year-over-year increase.

Interestingly, despite this robust spending, a significant portion — 35% of luxury purchases in 2024 occurred overseas, a notable rise from 18% in the previous year.

Growing Overseas Spending

Japan has been a prominent destination for overseas luxury spending among Mainland Chinese consumers. There are two primary reasons behind this.

First, the Japanese Yen has seen significant depreciation over recent years. On December 23, 2024, the Yen traded at 157 against the US Dollar, compared to approximately 145 in December 2023 and 135 in December 2022.

Second, Japan offers a wider variety of options, including specialty luxury items that are exclusive to the Japanese market and unavailable in Mainland China.

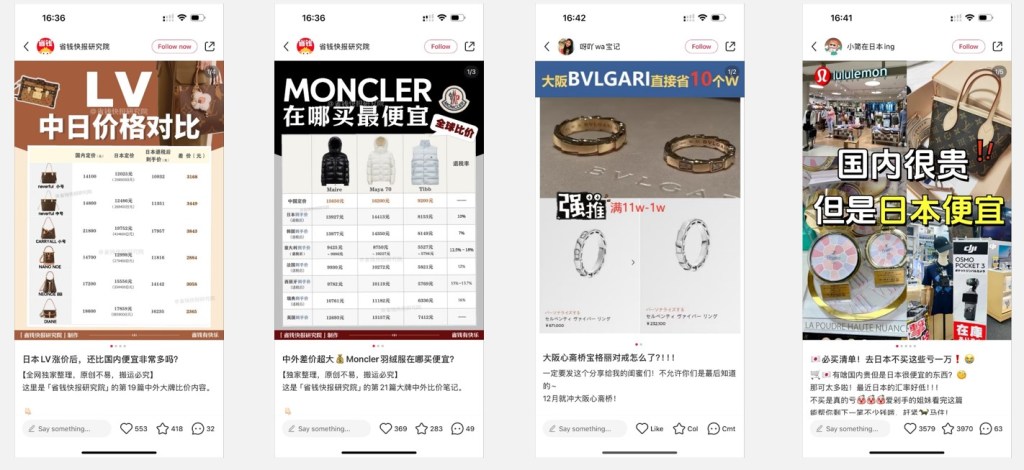

Unsurprisingly, sharing luxury shopping experiences on Chinese social media has become increasingly popular. Consumers eagerly discuss what to buy, where to buy it, and the best time to buy it.

Luxury Price Uplift

As in many other parts of the world, luxury products in Mainland China have become more expensive than ever.

According to FT.com, from 2020 to 2023, Dior increased its prices globally by over 60%, while Chanel and Moncler raised theirs by more than 50%. These price hikes were driven by rising production and logistics costs, alongside luxury brands’ efforts to enhance their prestigious positioning.

However, some luxury firms are now re-evaluating their pricing strategies. This shift comes in response to a noticeable softening in their performance, largely driven by Mainland China.

Young Chinese Consumers

Luxury consumers in Mainland China are young.

According to the 2024 China Luxury Market Insights Report published by Tencent and BCG, about half of Mainland China’s luxury consumers are now under the age of 30.

Some of these younger people are new luxury consumers. They are particularly drawn to the practical aspects of luxury items, such as higher quality, greater durability, and versatility for various occasions.

Some Thoughts

An important reminder: Luxury should be more than just a commodity.

Luxury brands should aim to connect with Mainland Chinese consumers on a deeper emotional level, which can also help justify the recent price increases.

While activations such as short videos, pop-up stores, and celebrity endorsements deliver short-term results, brand building via storytelling, coupled with cultural connections, offers a powerful way to appeal to Mainland Chinese consumers emotionally.

Brands need to take a step back and answer the following questions:

- Who are the target consumers?

- What are their lifestyles?

- What are their ambitions in life?

- What are their pain points in life?

- What are precious to them?

- How do they define luxury?

Brands must also carefully consider pricing strategies in response to softening performances. Would a price reduction, even a small one, dilute the brand’s prestigious positioning? Most importantly, are the target consumers truly sensitive to price changes so that a price reduction can really drive significant increases in revenue and market share?

What do you think? Let’s discuss.

Vincent

Leave a comment