My company, Intuit Research, conducted a nationwide survey of 1,015 Canadian respondents between May 14 and May 29. This survey examines consumer sentiment, economic confidence, and AI usage among Canadians during this transformative period.

From the results, we can see the importance of several aspects as follows. (For further descriptions, read pages 33 to 35 of the full report below.)

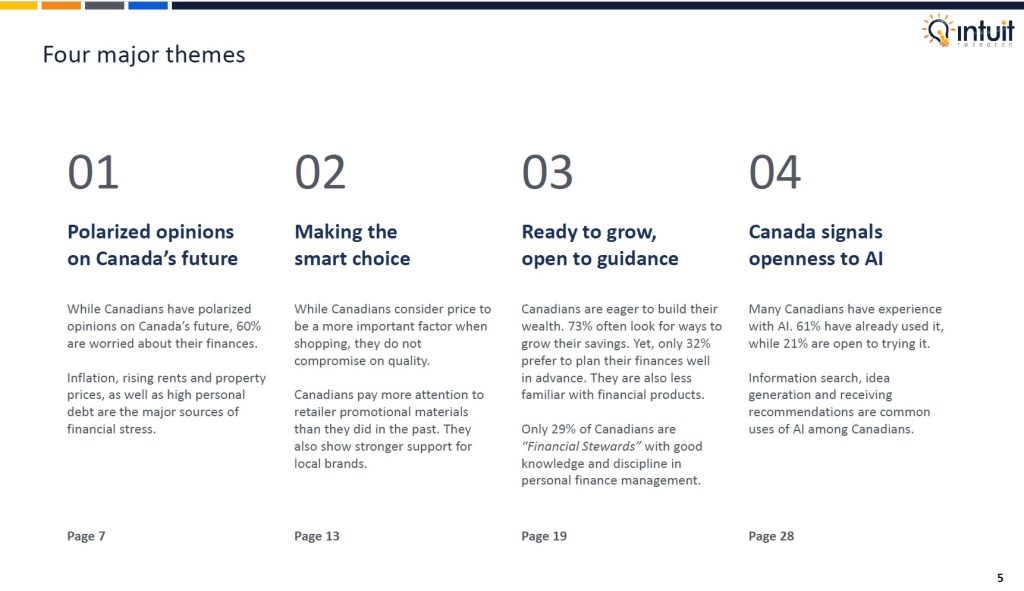

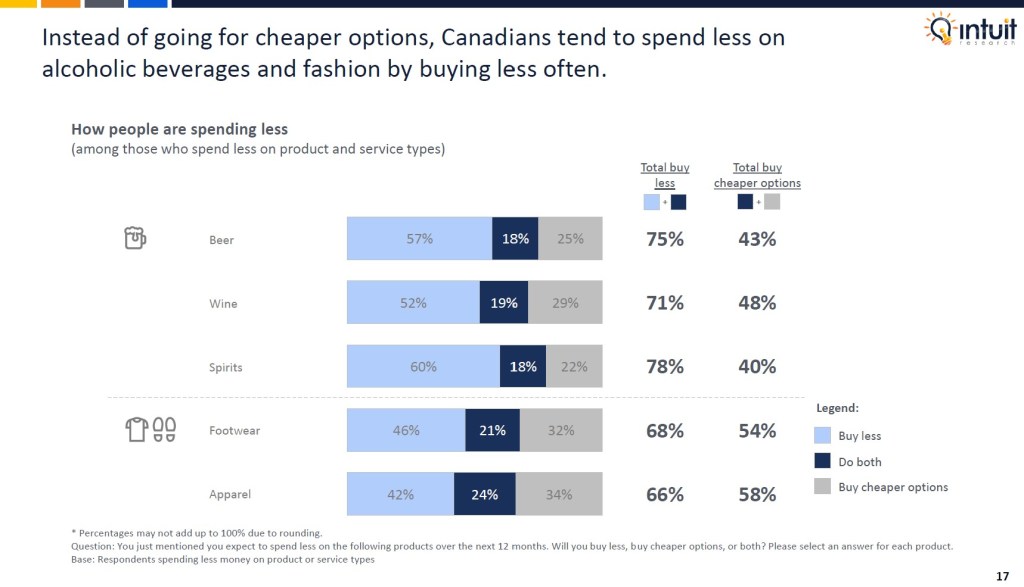

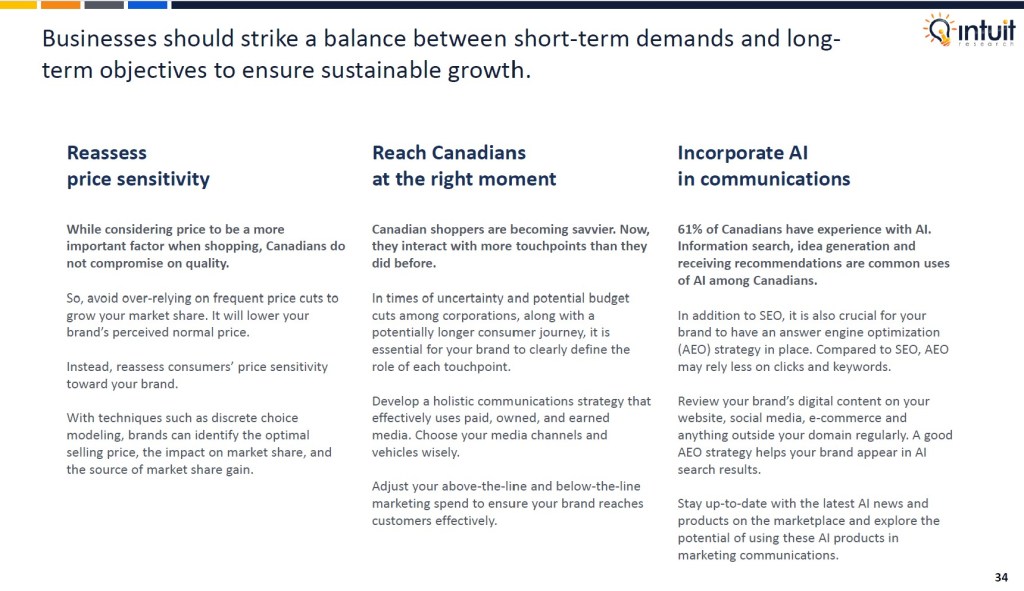

- Reassessing Canadians’ price sensitivity toward brands.

- Understanding the consumer journey and adjusting the media spend to better reach consumers.

- Incorporating AI in the communications plan and having an answer engine optimization (AEO) in place.

- Enhancing brands’ distinctive assets to ensure brands stand out in a competitive landscape.

- Delivering personalized messages to banking and insurance customers.

I hope this report inspires you on what your business should do next during this period with new possibilities.

I hope you have enjoyed reading the report. If you would like to discuss any further, let me know.

Vincent

I am Vincent Kwong, a seasoned consumer planner with 18 years of market research and business planning experience on both the agency and client sides. Currently, I am Director & Partner of Intuit Research, a research agency specializing in multi-country market research projects. Companies that I have served in my career include McDonald’s, Diageo, PepsiCo, Estee Lauder, Heineken, GSK, Pizza Hut and HSBC.

Leave a comment